To ensure you receive the best service possible,

please enter your zip code below:

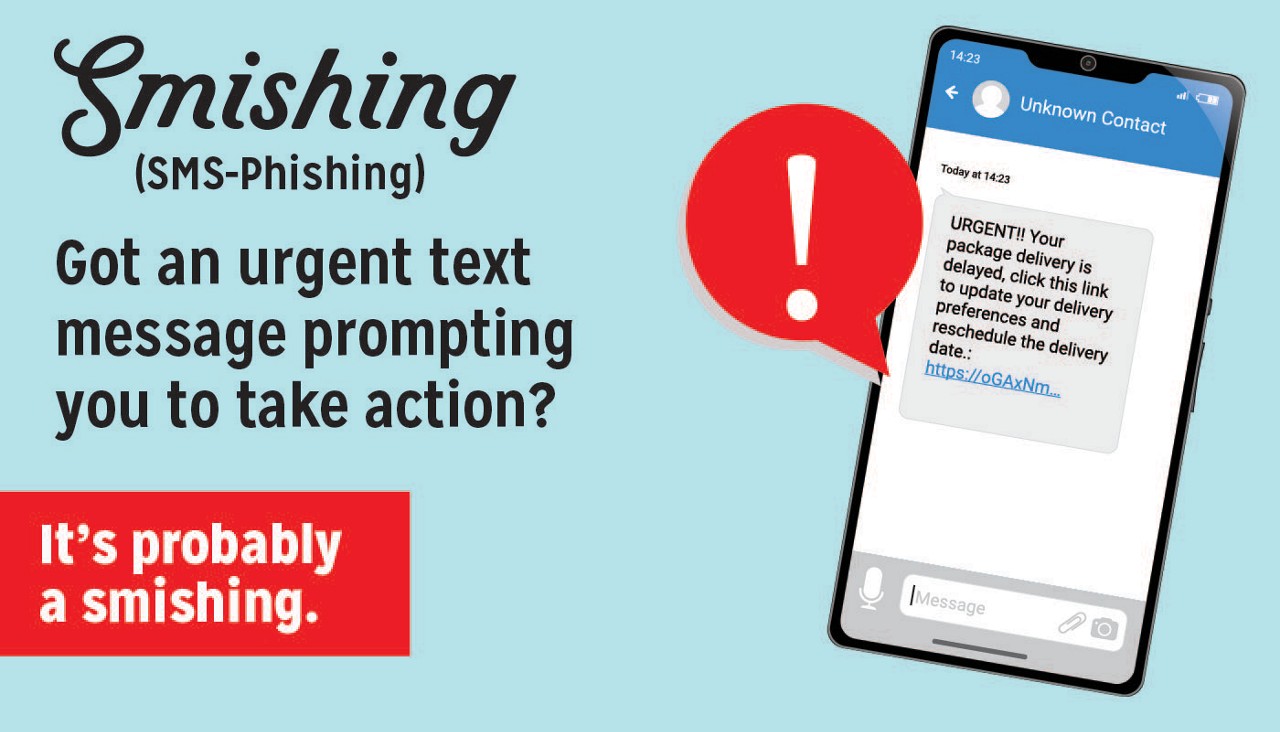

Cybercriminals use text messages in a scam called smishing, impersonating companies or agencies to steal personal information like passwords or credit card details.

Unfortunately, these schemes are on the rise. In 2023, smishing attacks increased by 20%, with 147 million fraudulent texts sent daily worldwide. Knowing the warning signs can help you avoid becoming a target.

Check out our video above to get the details on smishing.

What is smishing? Smishing involves scam text messages pretending to be from trusted sources like banks or government agencies. These messages create urgency to trick victims into clicking links or sharing personal information, leading to stolen data or malware attacks.

Phishing uses fake emails, while smishing targets victims through text messages. Smishing can be riskier since text messages have a higher open rate (98%) compared to emails (about 20%).

Smishing uses social engineering to trick you into sharing personal information through deceptive texts. These scams work because:

Smishing scams come in many forms but often follow similar patterns.

A text claims suspicious activity on your account and directs you to a fake site to steal your login.

A fake message about a missed delivery asks you to click a link and share personal or payment details.

A text claims your account is locked and directs you to a fake login page to steal your credentials.

You receive a text claiming to be a toll invoice, asking you to pay by clicking a link and entering your payment details.

Scammers claim you owe taxes or qualify for a refund, especially during tax season.

A message promises a prize, asking you to click a link and share personal or payment info.

A fake job offer asks for personal info or directs you to a fraudulent link.

To stay protected, it's important to know how smishing works in cybersecurity, including the tactics the scammers use and the warning signs to watch for.

Learn how to identify and avoid toll scam texts that target unsuspecting drivers. Protect your information with these tips.

Read more

Even if a text doesn't fit one of the more common scams, it could still be a fraud attempt. Watch for these general warning signs.

If something seems off, don't click the link or reply. Instead, contact the company directly through its official website or customer service number.

Take these steps to reduce your risk of falling for smishing and cybersecurity scams:

If you accidentally click a link or share personal information, take immediate action:

Stay alert and safe—smishing scams aren’t going away, but knowing the warning signs and taking simple precautions can help protect you and your loved ones. If a text message seems suspicious, don’t click; verify it independently. Being proactive can safeguard your accounts and identity. AAA members can access free benefits from ProtectMyID for extra protection to help keep their personal information secure.

By staying informed and vigilant, you can significantly reduce your risk of falling victim to smishing scams. Remember, a cautious approach and proactive measures can go a long way in safeguarding your personal and financial information.

Want to be protected?

AAA Members can click the link below to use Experian to help protect themselves online. Not a AAA Member? Join today to unlock exclusive savings like this and more.